Accountants and other financial professionals often have to present a cash flow statement to executives or the Board of Directors. This statement accounts for the inflow and outflow of cash in an organization in a particular time period. It starts with the Net Income from the Income Statement. Then the non-cash items are listed to reconcile the net income to the net cash from operations. Then the cash used in financing and investing is accounted for, along with any effect of foreign exchange rates. The result is the net change in cash and cash equivalents at the end of the time period.

This is one of the top three common financial statements, along with the income statement and the balance sheet. It is required to be prepared and reviewed under compliance rules. So most finance professionals copy the statement in table or spreadsheet format onto a slide. This leads to numerous questions from executives or board members.

What is a better way to present this required information? Some would suggest using a visual dashboard presentation, with graphs and visuals to represent the values or changes in values. I don’t think this will help the executives understand what they really need to know (read this article for more on my view of visual executive dashboards).

Instead, I suggest you don’t present the cash flow statement. How can I say that when I just said it is required? I didn’t say you don’t distribute the statement, I said I don’t think you should present it. I think you should send the statement in printed or PDF format. That satisfies the audit rules. In the presentation, focus on what the executives and Board really need, the insights behind the numbers on the cash flow statement.

In each section of the statement, there are important activities or reasons behind each number. Which of those will the executives or board members need to be aware of or make decisions on? Those should be the focus of your presentation.

If there is a new line in one of the sections that wasn’t there in previous statements, you need to explain why it is now being shown. Is it a change in accounting rules? Does this line contain new items or is it splitting another line into more detail? How can the audience evaluate the value without having a previous value to compare to? If you create a previous value, what assumptions did you have to make in order to come up with it? These are all important items the audience needs to be aware of.

For many of the individual line items, there are decisions made in the past that result in the value shown in the statement, such as financing or investment decisions. These only need to be highlighted to remind the audience of how past decisions are reflected in the current statement. If a decision did not result in the expected result, this should be called out, especially if different decisions need to now be made.

Some of the items can be compared to expected values and are forecasted each time period. For these items, focus on explaining why certain lines have an actual result that is significantly different than the expected value. If any decisions need to be considered because of the difference, explain the rationale for your recommendation. If a forecasted value has significantly changed for a future time period, explain why and explain any recommended actions that may need to be taken now or in the future.

You can make the important messages behind the numbers on the statement clear by using visuals instead of spreadsheets on slides. Here are some visuals that can be used to communicate some of the common messages that result from analysis of the items in a cash flow statement.

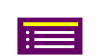

Bar chart to show key differences between actual and budgeted values

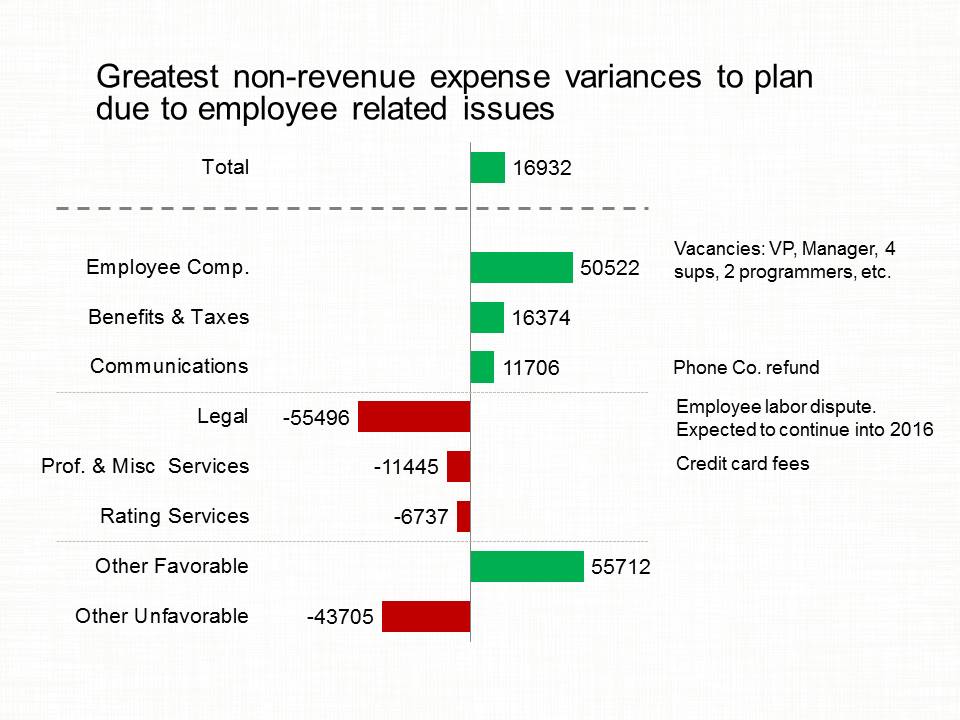

Waterfall graph to explain difference between previous and current forecast

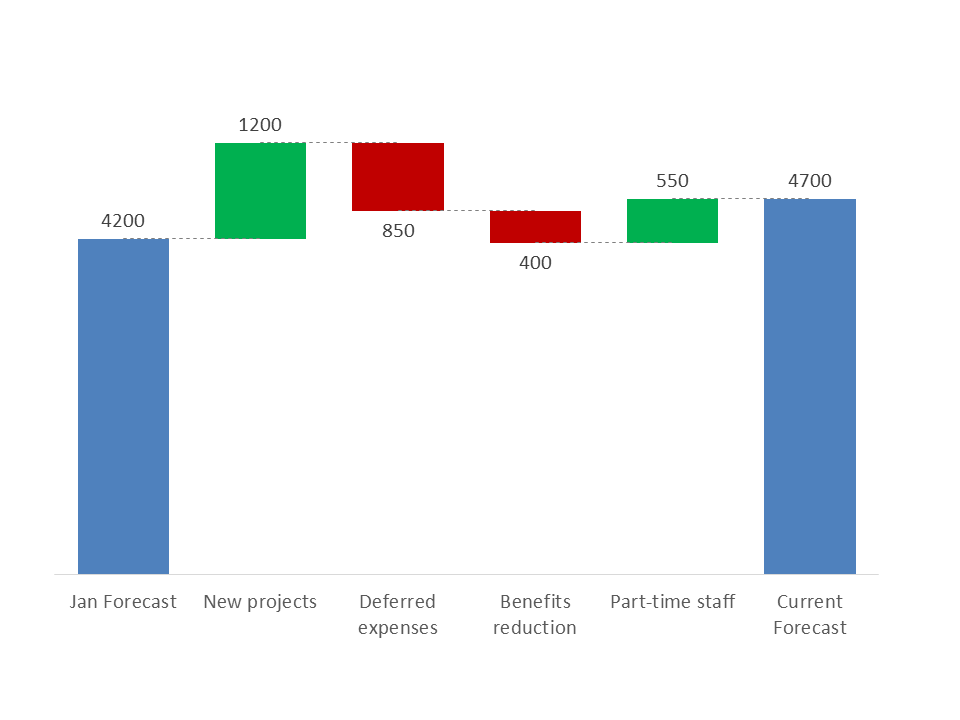

Multiple Width Overlapping Column Graph to show revenue performance compared to budget and previous year

(Note: All the visuals above were created in PowerPoint (and could have been done in Excel), so you can create effective visuals with the tools you already use.)

Even though the cash flow statement is required to be distributed to executives and the Board, it doesn’t mean you have to do it by copying it onto a slide. Distribute it in advance, and let them know that during your time with them, you will focus on the key items they need to know about and decisions they need to consider. This will make your time with them much more valuable and productive.

[If you are responsible for presenting financial statements, check out the other articles in this series on presenting an Income/P&L statement and presenting a balance sheet.]

Dave Paradi has over twenty-two years of experience delivering customized training workshops to help business professionals improve their presentations. He has written ten books and over 600 articles on the topic of effective presentations and his ideas have appeared in publications around the world. His focus is on helping corporate professionals visually communicate the messages in their data so they don’t overwhelm and confuse executives. Dave is one of fewer than ten people in North America recognized by Microsoft with the Most Valuable Professional Award for his contributions to the Excel, PowerPoint, and Teams communities. His articles and videos on virtual presenting have been viewed over 4.8 million times and liked over 17,000 times on YouTube.